Russia’s invasion of Ukraine in the last week has consumed traditional media and social media. This is as it should be considering the nature of the events and the clearly terrible consequences that it is having on the Ukrainian people themselves. From the broader perspective these events effect the world we live in as well as the values of investments, pensions and personal savings while, at the same time, possibly changing mortgage rates. Everything is connected, sometimes in an obvious way and sometimes in a not so obvious way.

Because of this we have published this particular document in order to give our clients a perspective on the current crisis – how it evolved as well as how it might impact their personal circumstances.

Why Does Putin Think That Russia is Entitled to Invade Ukraine?

Prior to the glasnost approach of openly and frankly discussing economic and political realities introduced under Mikhail Gorbachev there were 15 Soviet Socialist Republics, or SSRs. Those were Armenia, Azerbaijan, Belarus, Estonia, Georgia, Kazakhstan, Kyrgyzstan, Latvia, Lithuania, Moldova, Russia, Tajikistan, Turkmenistan, Ukraine, and Uzbekistan. Collectively they were referred to as the Union of Soviet Socialist Republics (USSR).

Putin sees himself as a Russian hero and wants to rebuild the great Russian Empire albeit in his own image rather than that which existed before the global wars of the 20th century. While many of the above mentioned states are still aligned with Russia, Estonia, Latvia and Lithuania are now members of NATO (North Atlantic Treaty Organisation) and are effectively under the protectorate of the US, UK and the European Union. Encroachment on their territory is not likely.

Ukraine, however, has been denied membership of NATO mainly because of the scale of its land border with Russia, a length of 2,000 km. This was not allowed mainly because of NATO’s reluctance to poke the Bear, so to speak, an act which has since emboldened Putin more in trying to draw Ukraine back under Russian control.

Russia invaded Georgia in 2008, a war that lasted 5 days but it still occupies 20% of that country. Ukraine with a far larger relative population (45m v Georgia 4m v Russia’s 145m) and a far greater land mass and stronger military will not be as easy to overcome.

Apart from the nationalistic goal of Putin to rebuild the Russian empire Ukraine itself is effectively a significant “breadbasket” of food production and would bring considerable international revenues to the Russian State as well as helping to feed its own people.

At the very least Putin’s goal is to install a puppet administration backed by force but nonetheless he is already facing popular resistance from the Ukrainian people who have long shifted in their thinking to the West. While the Russian army’s forces hold the upper hand at the moment, the likelihood is that a long-term guerrilla campaign by Ukrainians might probably ensue. As Russia experienced in Afghanistan in the 1980s such defences can take many years to subdue the population and in this case are likely to be supported directly by US and European governments. Hence, Putin’s rattling of the nuclear readiness sabre over the weekend as well as his willingness to appear to enter peace negotiations through Belarussia.

The Impact On Markets

While this is a conflict that is local to Russia and Ukraine it has global ramifications on many commodities.

West Texas Intermediate Oil is trading at US$91, recovering from a low of just under US$13 two years ago. Russia is the third largest producer of oil in the world behind the US and Saudi Arabia and accounts for 12% of global supply. The only way this trend will be reversed is if OPEC members look to increase supply.

Natural Gas, already at a very high level price, is set to get even higher even though there has been an increase of 50% this year. Russia is the world’s second-largest supplier of natural gas, behind the US, with 16.6% of global supply. Europe, and in particular Germany, is dependent on Russia on its gas supply although it also sources liquefied natural gas from Qatar and Australia. Even though Europe is now heading into the summer, it will take up to a year to replenish stocks which, in turn, will lead to increased gas prices. While Ireland is supplied by gas from the Corrib fields off the West Coast it only accounts for 25% of Ireland’s needs (with the balance from the UK) global supply and demand pricing will still result in higher prices for Irish consumers as such pricing is globally set.

Aluminium reached US$3,480 a tonne last week and Russia produces 6% of global supply. While not mentioned very often it is used so much within modern society. Many vehicles – aircraft, cars and trains use it due to its strength to weight ratio. Similarly, many buildings are made with aluminium due to its resistance to corrosion while its low density makes it the best option for long distance power lines. It is also used in smartphones, tablets, laptops, and flat screen TVs.

Palladium which is used in catalytic converters to scrub pollutants from the exhaust gases of petrol cars has increased by 23% this year. Russia accounts for 40% of global supply.

Nickel is used in the manufacture of stainless steel and batteries, making it a key part of the supply chain of electric vehicles. With the trend to ESG investing nickel is one of the key materials in the transition towards Zero Emissions. It has been almost 10 years since for demand for this metal was as high. Russia provides 6% of global output.

Wheat is the commodity that has the largest direct impact of the current crisis. Between them, Russia and Ukraine produce 25% of the global supply. Most of Ukraine’s output is sold to Mediterranean, North Africa and the Middle East. In the last few days, Egypt has rescheduled its tender for wheat supplies due to the recent high prices but it is likely that prices will continue to rise irrespective.

The Black Sea region accounts for 60% of world’s output of Sunflower Oil which is a key component of many food manufacturing processes. Its price has risen by 12% in the last year and has led to increased demand for palm oil and soya oil replacements.

Before this crisis came into being there were concerns about whether Covid led high inflation was likely to remain for a longer period or was it just a short-term phenomenon. The worry is now whether higher commodity prices may drive inflation further as well as reduce growth through lower consumption. While sanctions placed on Russia will have a significant negative impact on the Russian economy they will also have repercussions for the global economy, especially in Europe.

In the possible long-term environment of high inflation global central banks will have limited ability to act by reducing interest rates. This being said, the US Federal Reserve (otherwise referred to as the Fed) may slow the pace of expected rate rises due to the possibility of even higher inflation following commodity price rises. The ECB for its part may be more inclined to provide additional support to offset the negative consequences of the crisis on the European economy. In either event, stockmarkets are more likely to move further down rather than up in the short term.

The weekend blocking of Russian access to the SWIFT bank settlement system, barring convertibility of the Russian Ruble into other foreign currencies, has had an immediate effect as Russians themselves immediately surged to foreign owned ATMs within Russia to withdraw cash in foreign currencies. Already today International aircraft leasing companies are trying to terminate their lease agreements with Russian airlines in an attempt to protect their aircraft and get them flown to outside the Russian state. Many of these leasing companies are based in Ireland but it remains to be seen whether the Russian State will allow such aircraft to leave since their departure would seriously impact Russian internal transportation options for Russian citizens. In turn, this will impact the stock market valuation of many international aircraft leasing companies.

Overnight, the oil company BP’s decision to sell its almost 20% stake in Rosneft (Russia’s leading oil company), a shareholding it has held for nearly a decade, is likely to be the first of many such detachments by foreign investors of Russian businesses. The problem for BP now is how it would dispose of a stake worth many billions of pounds in a company controlled by what has become the world’s most prominent pariah state. Will Russia just say “thank you” and arrange its legal system to approve the full takeover of BP’s shares without actually having to pay anything for them? Similar decisions will face other global businesses that have made serious investments in Russian companies where the main shareholder is also the Russian state itself.

What Will Be The Political Outcomes?

Irrespective of how the current crisis ends, it is likely to increase pressure on the EU to reduce its energy dependence and cooperation with Moscow, the blocking of the Nordstream 2 pipeline being the first such move. Considering China’s ambivalence in not denouncing Russia at the United Nations Security Council it points to a possible similar threat of China trying to annex Taiwan, although this is considerably more difficult due to the existence of international seas rather than an immediate land border. Time will tell as to whether China will be so aggressive as it is likely to watch the political and financial fallout on Russia by the use of international sanctions.

As for Ukraine, the outlook is very difficult to predict. There is little Western appetite to defend it with boots on the ground – Biden made it clear last week that the US would not be doing so. As Putin has been far more willing to use military force to pursue his expansionist objectives it seems more likely that Russia will bring a substantial part of Ukraine back into its influence. Albeit, that this may come with an ongoing guerrilla engagement with a substantial portion of Western Ukraine population. Those that reside on the Eastern part of Ukraine will be very firmly under the thumb of Russian military.

Where To Now For Stockmarkets?

Stockmarkets have always been driven by geopolitical events with initial negative reactions swift and, in many cases, recoveries happening also relatively quickly. The most recent example before the Russian invasion was the global health and financial reaction to Covid. Two years ago stock markets fell 35% over a six week period only to recover those falls in values over the subsequent four months. How the current crisis will play out will depend on a myriad of circumstances that are generated by reactions to the likely high death toll and the way that some of these deaths are reported especially if thermobaric weaponry is used, the medium to long term impact of financial sanctions and equity markets could remain volatile in the short term until greater clarity is evident.

At the time of writing and as someone who has been in the investment advisory business for almost 40 years, markets go from being overly complacent to being overly pessimistic, discounting a prolonged period of stagnant growth. This is nothing new. Any examination of past stock markets over any rolling 15year period will actually show short sharp shocks followed by longer term gradual recoveries which very much compensate for the interim falls.

Widespread stock market corrections are inevitable and it’s a matter of when not if, so investors are always on the lookout for a reason to sell. Stock market falls and crashes are, whilst very uncomfortable, normal. They are the rule, not the exception, and are part of the journey that impact our personal investments and pension funds.

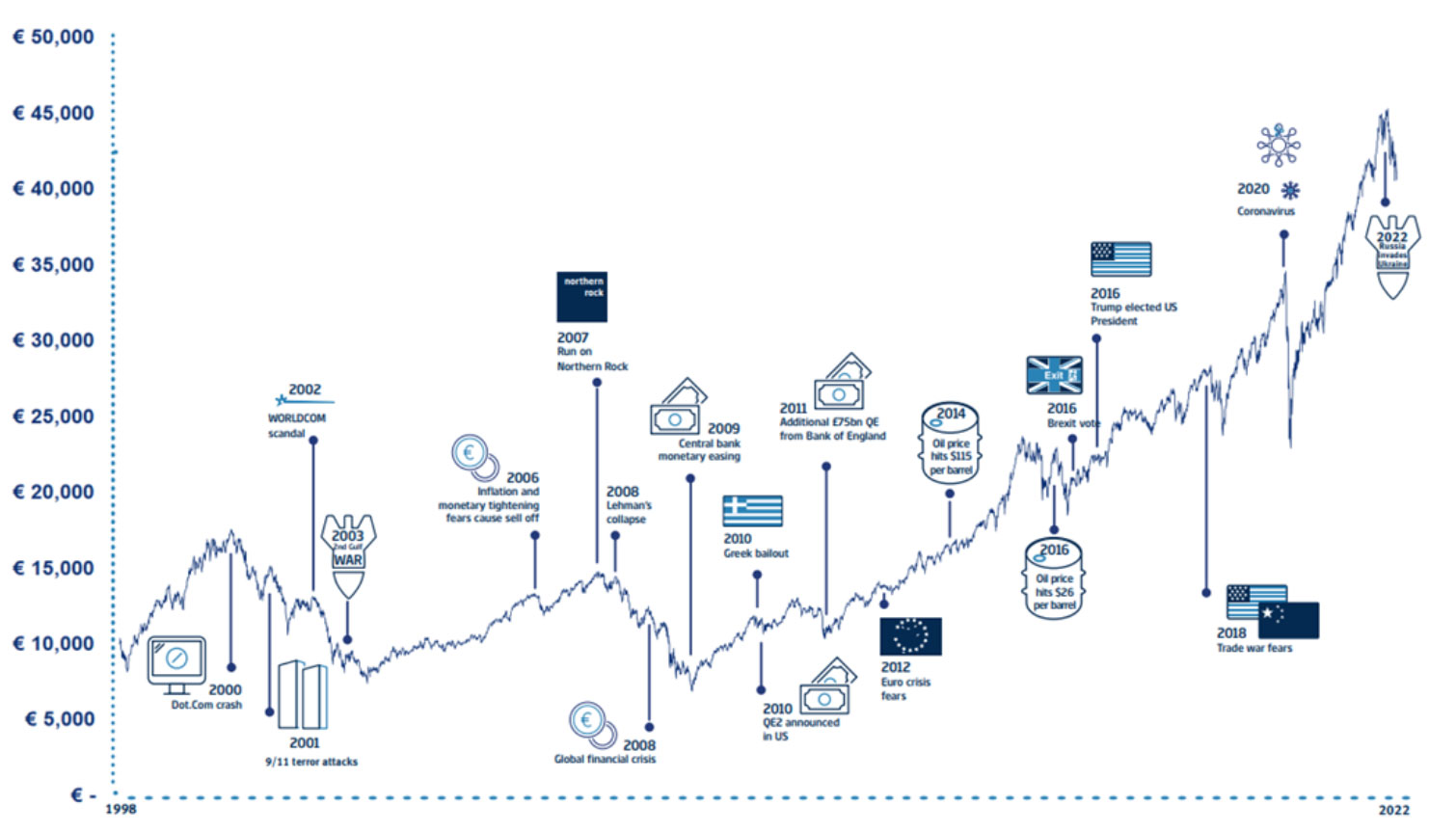

Stock market history shows us time and again that this happens. Just like the weather changes throughout the seasons, markets go through cycles of good and bad periods. Any investor with a long-term time horizon should expect to see this happen. To fully appreciate these cycles it is worth reviewing some of the more notable and momentous falls in living memory and how investors would have fared over the long-term had they remained composed. The chart above shows a euro investor with 100% of their money in global equities just before the market crash in January 2000 to the weekend just gone.

The key thing is to expect market corrections – and many of them over the long term. There has been at least 15 corrections (a correction is defined as a decline of 10% or more) and eight bear markets (a decline of 20% of more) since 1980 (using the dollar performance of the MSCI World All Country Index as a proxy for the stock market). Equity markets give a positive expected return above less risky assets such as cash deposits because of this volatility. It is the long-term price that investors must pay in order to reap the rewards of positive expected growth over time. Stepping back from short-term thinking, and instead considering the recent turbulence in the context of any person’s long-term financial plan, the correct question shifts from ‘Should one sell?’ to “Is now a good time to buy given that equity markets are cheaper now than they were?’

No amount of watching the news will provide you with the clarity you are seeking with regard to stock market movements in the short term. Steve Forbes, the founder of “Forbes” magazine, once famously said “You make more money selling advice than following it. It’s one of the things we count on in the magazine business – along with the short memory of our readers.” As humans, we are hard-wired to seek out information that may represent a threat to us and then act quickly to preserve ourselves and live to fight another day, if you excuse the analogy in the current crisis. Is it any wonder therefore that many of us remain glued to the media at times like this? Regardless of what any latest crisis is about (this time it is Ukraine), we have experienced market falls and then market recoveries as economies themselves recovered.

Listening To Sound Financial Advcice?

Who would have ever invested having listened to or read all of this? Yet the press hardly ever reports stories of gradual and solid growth, perhaps because such growth is the norm while falls are the exception. Markets have always delivered over the long term. Yes, some investors have been luckier than others depending on when they invested, but that is just luck – and luck permeates every aspect of our lives, not just investing.

Turn off the radio, go for a walk and remind yourself about what is important – tune out the noise. As humans we use a mental heuristic or shortcut of over weighting recent information – look beyond the recent headlines. Focus on what you can control – your own investment risk level versus your need and willingness to take risk, diversification, controlling costs, managing taxes, rebalancing appropriately and keeping a long-term view.

How Does This Impact My Pensions and Investments?

This depends on how your funds are invested. If you are invested 100% in equity funds then most likely your funds will experience a parallel downward movement in line with the falls of the major stock market indices such as the FT100, Eurostoxx 600, the Dow Jones and S&P 500. On the other hand, if you are in a mixed fund, normally referred to as a Managed Fund, the percentage reduction will broadly depend on your holding of equities. If your equity position is circa 60% of your portfolio then you will most likely have seen a fall of circa 60% of whatever these global equity indices have experienced. It is really important to understand that these are falls in value and not outright losses.

A good analogy to understand these falls is to look at them in the same context as to how you might value a family home. If the price of a nearby house is sold for less than what it was originally purchased then that fall in value only impacts the house that was sold. Your own house has not lost any value as you have not sold it. So when, over time, local property prices increase, so will the relative financial value of your own home. Losses or gains on homes are of no consequence unless the house itself is sold. This is the same with stock market investments.

Our Advice Can Be Summarised As Follows:

If your targeted retirement age is more than 10 years away (and many of our clients retirement dates are at least 20 years away) then the recent volatility is no real concern as these falls in value are broadly regular occurrences, albeit that most such falls don’t have the dramatic background of the current health problem!

- If your targeted retirement age is more than 10 years away (and many of our clients retirement dates are at least 20 years away) then the recent volatility is no real concern as these falls in value are broadly regular occurrences, albeit that most such falls don’t have the dramatic background of the current health problem!

- If you are continuing to make, say, monthly contributions to your pension fund then the next few months will be an opportunity to invest at cheaper fund prices than in the past.

- Similarly, if you are not likely to need access to investments in the next 7 or 8 years then hold tight and the market will recover – see our explainer notes above.

- For our clients who are looking to retire in the next few years we have always advocated that you have sufficient cash either in your pension account or on hand in a personal account to smooth over downturns such as those experienced in the last few weeks.

- Similarly, if you have retired, we have always made it a priority that our clients hold at least three years’ expenditure in cash so as to provide personal liquidity for emergencies and not need to cash out from their post retirement funds.

- Finally, if you have cash deposits that are not needed for liquidity or emergency funds then the next few months will be an opportunity to consider making long term investments, all for the historical reasons set out.

Need Advice Now?

We recognise that sending out a written document to our clients and other interested parties is not enough and that many of you may want to discuss your own situation further. This is a natural reaction and we are very happy to meet with you to assist you in understanding how the current crisis impacts on your personal investments and pension funds. We’re here to help and to make sure that your personal financial plan stays on track so that you and your loved ones have a secure future.

Find Out How We Can Help You

Improve your financial future by arranging a call back or online meeting.

Simply book yourself into an appointment at one of our available times.